Thin air, shifting weather and long approaches can turn a pleasant trek into a problem that needs quick, calm choices. That is when travel insurance stops being paperwork and becomes practical help. Remote routes can sit far from clinics, so even a routine check may involve private transport and extra nights that stretch a budget.

This blog explains how altitude illness is treated in typical policies, how damaged kit is handled, which sections deserve close reading and the habits that make any claim smoother.

Why Altitude Sickness Disrupts Trips?

Even well-prepared travellers can feel unwell after a quick gain in height. Early signs often include headache, nausea, dizziness and disturbed sleep. A slower pace and steady hydration help, yet itineraries still change because of weather, limited facilities and group pressure. When rest or descent is advised, plans are disrupted by extra transport, added nights and medical checks.

Domestic travel insurance India plans that list trekking can support clinic visits in hill towns, vehicle descent to a safer level and baggage cover when cameras or jackets are damaged.

If the route crosses a border, policies that include travel health insurance set out how altitude illness is treated and how partner hospitals handle care when needed.

How Damaged Kit Affects Plans

A cracked phone screen can end navigation apps. A broken lens can halt filming. A torn-down jacket can remove essential warmth that keeps a group moving. Some plans treat cameras, drones and GPS units as baggage while others require them to be listed with separate limits.

Clear photos of each item before the journey and again after any incident help to show ownership and condition. Receipts and serial numbers kept in a shared folder save time when the signal is weak. Travellers searching for the best travel insurance for active holidays often pay more attention to gadget sub-limits than headline figures.

Policy Sections that Deserve Careful Reading

Small print shapes outcomes more than price or marketing lines. Focus on areas that matter in rough terrain and at height.

- Activities and Elevation Band: Match the wording to the style of trekking, whether you buy travel insurance online or through an adviser.

- Emergency Medical Treatment: Check eligibility for altitude-related illness and any cashless network hospital.

- Evacuation Support: Confirm hired vehicle costs, airlift where offered and any need for prior approval.

- Baggage and Equipment: Note per item limits and depreciation tables for cameras, drones and GPS devices.

- Trip Curtailment and Interruption: Understand how unused bookings and onward transport are treated.

- Exclusions: Look for references to alcohol, ignored medical advice and careless handling of rented gear.

Comparing Plans With a Calm Head

Price tables can distract from the details that decide outcomes on a mountain path. Build a shortlist, then download the full policy wordings and read the sections that relate to trekking. Written confirmation from customer support is helpful if the route includes high passes or if carrying a drone for filming.

Screenshots of key inclusions stored with the PDF can support a later discussion when the purchase is made through travel insurance online marketplaces. A sensible choice balances activity definitions, evacuation triggers and realistic values for equipment.

Domestic and International Choices for Indian Travellers

Many adventures remain inside the country. Travel insurance India plans often offer medical support, baggage protection and interruption cover for interstate travel. Some holidays include a short foreign leg. Policies that include robust travel health insurance for the overseas portion can make access to treatment simpler.

When an itinerary includes both domestic and foreign segments, read the wording for each part rather than assuming one section applies to the whole journey.

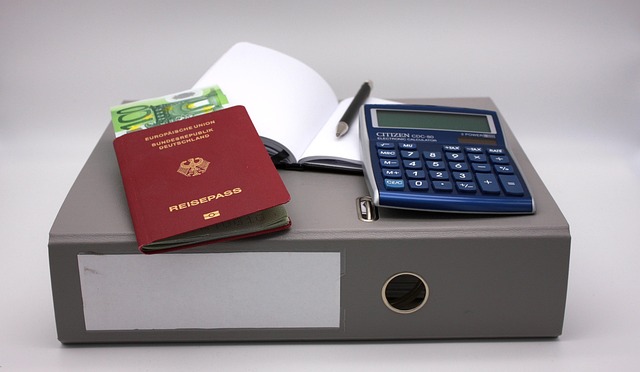

Buying and Documenting Without Stress

Plenty of travellers prefer to buy travel insurance online after booking transport and before paying the final trek invoice. Enter accurate start and end dates and include buffer days in case of weather delays. Add every activity that might take place, rather than only the minimum.

Keep the policy PDF, emergency numbers and identification on the phone and in a cloud folder shared with a trusted contact who understands the route. A simple organisation reduces delays when the signal is weak.

Pre-Trip Habits that Support Smooth Claims

Good habits reduce risk and help with paperwork if plans change.

- Basic medical check with prescriptions and a short fitness note.

- Operator due diligence with written safety and evacuation steps.

- Photos, serial numbers and receipts for high-value kit kept together.

- Daily log with height reached, rest decisions and any equipment issues.

- Careful storage of receipts for clinics, medicines, vehicle hire and extra accommodation.

Common Pitfalls to Avoid

Rejected claims often follow vague activity wording. Do not assume trekking covers every ascent or winter route. When comparing the best travel insurance, seek clear definitions and sensible gadget limits.

Check the item’s electronics limits and depreciation. With domestic travel insurance India, evacuation may need prior approval. Keep written confirmations and call assistance early, noting time and advice.

Conclusion

Adventure travel rewards steady preparation and clear decisions. Choosing travel insurance that matches planned activities, sets out medical and evacuation support and explains equipment cover in plain language gives structure when conditions change.

Compare calmly, confirm details in writing and keep documents close so that altitude headaches or broken gear become setbacks rather than trip enders.